Trillions of dollars in tokenized assets

By 2020, fractionalization of assets is estimated to become a trillion dollar industry. These are exciting times for Tokenine.com

So what’s Fractionalization all about?

Fractionalization = Divided Ownership

Try to re-imagine ownership …what assets could have divided ownerships? real estate? gold? oil? intellectual property? music? movies? cars? talent?

If you can, then imagine this:

An example of the old standard:

A property developer has a $1.5 billion sellout projection for an apartment project.

The process today is as follows:

- Hire brokers (internal och external)

- Create prospectus and sellout 25–30% of the project

- Get mostly in country funds

- Start construction for the project after the initial 25–30% is sold

- Continue to sell full apartments to clients through brokers until sold out

This takes many years and some projects don’t sell out fully, it’s all about the buzz and getting enough people through the door to either buy to live in or to speculate on the possible increase in value + rental income.

An example of the new standard:

A property developer has a $1.5 billion sellout projection for an apartment project.

Now imagine giving people the possibility to just buy 1 sqft, or 1 sqm of a apartment, even just a fraction of a sqft. This would allow someone to speculate in a diversified manner and invest into different real estate projects.

The process with tokenization / fractionalization will be the following:

- Get/rent/license/create technical infrastructure to create a security token

- Hire brokers

- Create prospectus and tokenize 25–30% of the project in token format

- Guarantee a return for anyone placing money into the token as part of an investment

- Start marketing the project globally and reach a international market

- Start construction for the project after the initial 25–30% is sold

- Continue to sell full apartments to clients through brokers until sold out or start tokenizing a bigger chunk of the project

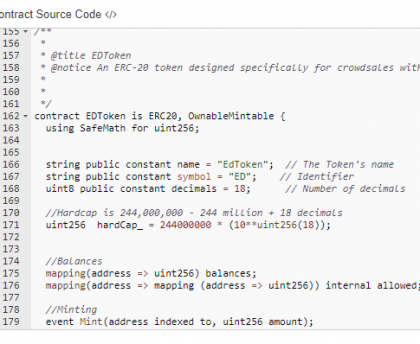

With the current blockchain infrastructure this is now possible for the first time ever. The leading plattform is Ethereum as most digital assets out there are based on the ERC-20 standard.

Which of these two scenarios do you believe would sell out first? We obviously believe in the latter as we open up a completely new demographic that can now purchase into these investments.

So. this would allow a project to have investors from all across the globe speculating in a specific market, or even a specifik apartment.

ERC-1404 self regulatory tokens - simple restricted token standard

A lawmakers dream, this will create the next hype in the cryptocurrency world and also set a new standard in the financial industry.

A new standard is also born for using Ethereum and security token offerings. A way of self regulation. What this standard does is add on-top of the ERC-20 standard, functions are added to restrict sending tokens to non verified wallets.

contract ERC1404 is ERC20 {

function detectTransferRestriction (address from, address to, uint256 value) public view returns (uint8);

function messageForTransferRestriction (uint8 restrictionCode) public view returns (string);

}

The old standard with ERC-20 only:

A verification is done in KYC / AML to let a investor buy.

Verified ERC-20 Wallet - -Send to — > Whatever ERC-20 Wallet —> Success

Here the control is lost as a verified wallet can send tokens to a non verified wallet and here the company lost information about ownership.

The new standard with ERC-20 and ERC-1404:

A verification is done in KYC / AML to let a investor buy.

Add functionality based on ERC-1404

Verified ERC-20 Wallet — -Send to → Whatever ERC-20 Wallet → Fail

Verified ERC-20 Wallet — -Send to → Non-verified ERC-20 Wallet → Fail

Verified ERC-20 Wallet — -Send to → Verified ERC-20 Wallet → Success

As you can see the new standard only lets regulated and verified wallets get access to the tokens. All of a sudden we are able to regulate the tokens thus making it legally compliant.

Regulations for Security Tokens.

We have many countries in the world that are looking to start regulating security tokens, Abu Dhabi has already passed a motion to create a freezone for creating STO:s from the Arab regions, this will happen early 2019. Malta released their license for exchanges with the possibility to list security tokens on exchange on the 1st of november.

Imagine this and how you can take advantage of this new financial industry that is growing from the ashes. We think this is truly exciting and we believe that a big part of the future financial instruments will be in blockchain the coming 5–10 years.